Biosimilars Insurance Coverage: What You Need to Know About Cost and Access

When you hear biosimilars, copycat versions of expensive biologic drugs that work just like the original but cost far less. Also known as biologic similars, they’re not generics—they’re more complex, made from living cells, and designed to match the structure and function of drugs like Humira or Enbrel. These drugs are changing how people with rheumatoid arthritis, Crohn’s, psoriasis, and cancer pay for treatment. But here’s the catch: just because they exist doesn’t mean your insurance will cover them easily.

Biologic drugs, high-cost medications made from proteins that target specific parts of the immune system often cost over $10,000 a year. That’s why biosimilars were created—to bring down prices without sacrificing effectiveness. But insurance companies don’t always treat them like the cheaper option they are. Some require you to try the brand-name drug first. Others only cover biosimilars if your doctor jumps through extra hoops. And a few plans still don’t list them at all, even though the FDA says they’re safe and effective.

It’s not just about the drug itself—it’s about drug pricing, how pharmaceutical companies set costs and how insurers negotiate access. Many insurers push biosimilars because they save money, but the savings don’t always reach you. You might still pay a high copay if the biosimilar is in a higher tier. Or your plan might cover the brand-name drug with a lower copay because the manufacturer pays the insurer a rebate. That’s why knowing your plan’s formulary and tier structure matters more than you think.

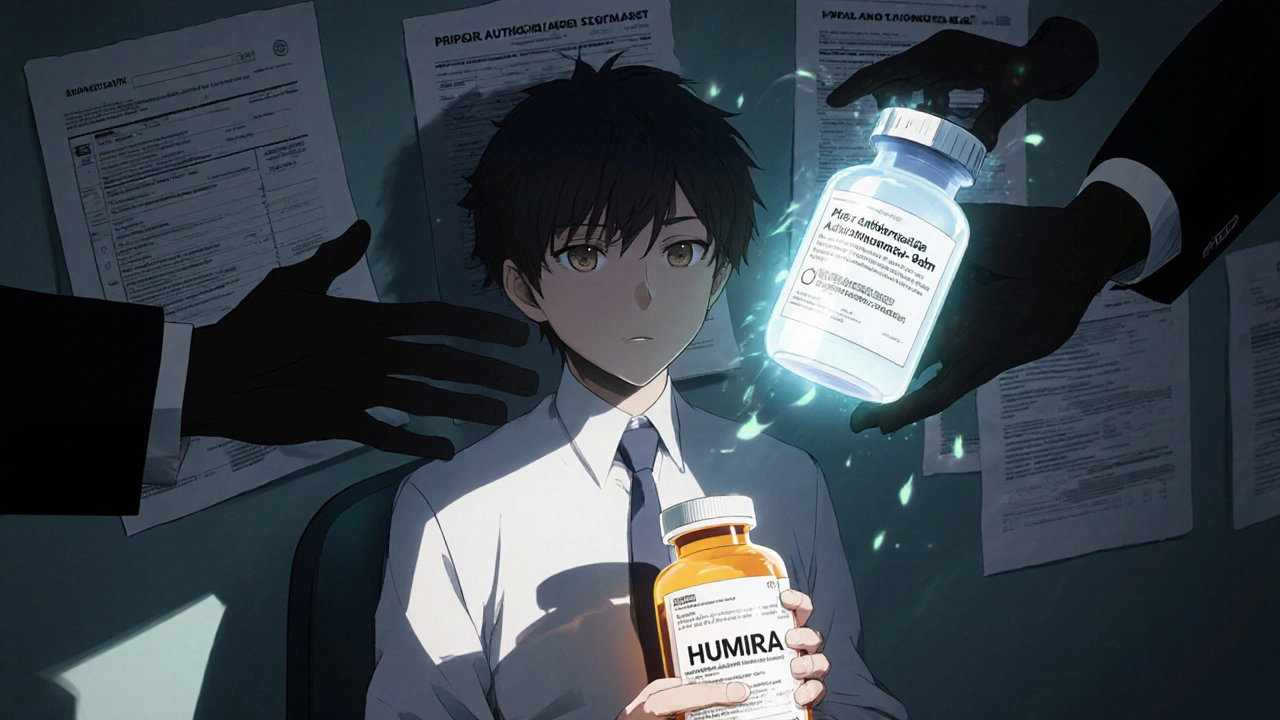

Medication access, whether you can actually get the drug you need without delays or denials isn’t just a doctor’s call—it’s a battle with paperwork, prior authorizations, and appeals. Some patients wait months to switch from a brand to a biosimilar, even when their doctor says it’s safe. Others get denied outright because the insurer says the biosimilar isn’t "medically necessary"—even though the science says otherwise.

What you’ll find below isn’t theory. It’s real stories and facts from people who’ve dealt with insurance denials, pharmacy delays, and confusing coverage rules. You’ll see how biosimilars are being used in practice, what insurers are hiding in their fine print, and how to fight back when your coverage doesn’t match your needs. These posts cover everything from how biosimilars are approved to what to say when your pharmacist says "it’s not covered." There’s no fluff. Just what you need to know to get the right drug at the right price.

Insurance Coverage of Biosimilars: How Prior Authorization and Tier Placement Block Savings

Biosimilars can cut biologic drug costs by up to 33%, but insurance rules like prior authorization and same-tier placement block access. Here's how coverage works - and what you can do about it.